Cibil Score

Cibil Score

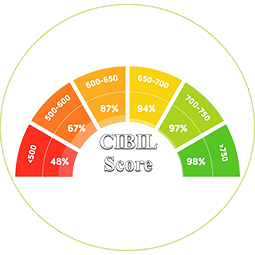

A CIBIL Score is a consumer's credit score. Simply put, this is a 3-digit numeric summary of a consumer's credit history and a reflection of the person's credit profile.

What is a CIBIL Score?

The Credit Information Bureau (India) Ltd, popularly known as CIBIL is a Reserve Bank of India (RBI) authorised credit agency. It offers CIBIL scores and CIBIL reports for individuals. A CIBIL score is generated by the bureau after considering an individual’s detailed credit information. The agency also offers credit report services to the banks and other NBFC (Non-banking financial companies). A CIBIL score is a three-digit number between 300-900, 300 being the lowest, that represents an individual’s credit worthiness. A higher CIBIL score suggests good credit history and responsible repayment behavior. CIBIL scores are calculated on the basis of at least 6 months of historical financial data of an individual. The data is fed into an algorithm with 258 different variables; each with a different weightage.

A CIBIL Score is a numeric summary of credit history that is calculated based on the following factors:

| Track Record of Past Payments |

|

| Previous Settlements, Defaults, Write-offs |

|

| Loans as Proportion of Income |

|

| Secured Loans vs. Unsecured Loans and credit cards |

|

| Loan Equities |

|

SEND ENQUIRY