Corporate-Partnership Deed

Corporate-Partnership Deed

Corporate-Partnership Deed

Partnership Deed Format

A partnership deed is a written legal document to avoid unnecessary misunderstanding, harassment and unpleasantness among the partners in the event of any dispute. For mutual benefit, the registration of Deed of Partnership is made under the Indian Registration Act, 1908 so as to avoid apprehension of the Deed of partnership being destroyed or mutilated in the possession of the partners. However, a partnership firm can also be created without registration under the Indian Registration Act, by just entering into a deep of Partnership. An instrument of partnership may be constituted by more than one document, meaning an amendment agreement can be added to a partnership deed at anytime to change the terms of a Partnership Firm.

Why Create a Partnership Deed?

Partnership Agreements are be used by Partners wishing to form a partnership for doing business together. It is strongly recommended or encouraged for partnerships to have some kind of agreement among themselves, in case future disputes prove difficult to arbitrate. It is meant to promote mutual understanding and avoid mistrust. It indicates the terms on which the business corporation is founded.

Also, registration of a Partnership will make the firm eligible for obtaining PAN, applying for bank loan, opening bank account in Partnership Firm name, obtaining GST registration or IE Code or FSSAI license in partnership firm name and more.

Executing a Partnership Deed

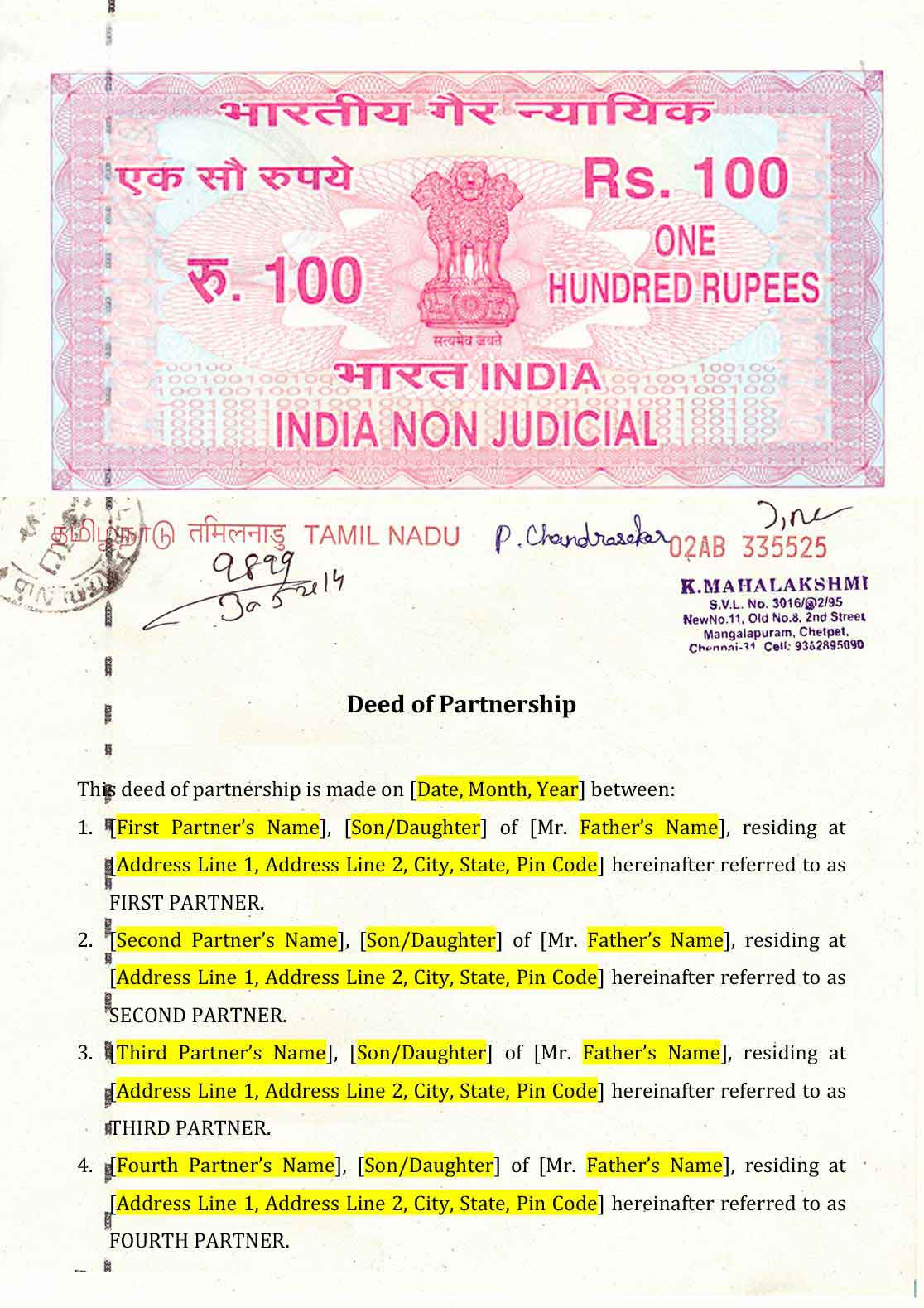

Partnership agreement must be printed on a Non-Judicial Stamp Paper with a value of Rs.100/- or more based on the value of properties held in the partnership firm. The partnership agreement is usually signed in the presence of all the partners and each of the partners would retain a signed original for his/her records. Once the document is signed by the Partners, the document is witnessed and the signed partnership deed is held by each of the Partners is duplicate or triplicate.

Sample Partnership Deed

SEND ENQUIRY